What is Planned Giving?

Planned giving, or estate planning, provides you with the opportunity to make a gift to FriendshipWorks after your lifetime. Supporters who wish to establish their legacy of philanthropy with FriendshipWorks commonly do so by making a provision in their will to ensure our work to end elder isolation thrives for generations to come.

The process to include FriendshipWorks in your estate planning is easy…and you don’t have to be a billionaire!

Everyone can benefit from having a will to carry out their wishes, and designating a planned gift bequest to FriendshipWorks takes just minutes. And when you do, you’ll automatically become a member of our Legacy Society.

What is the FriendshipWorks Legacy Society?

Members of our Legacy Society are generous and forward-thinking individuals who have made FriendshipWorks one of their top charitable giving options and share a common desire to continue their giving after their lifetime through estate planning.

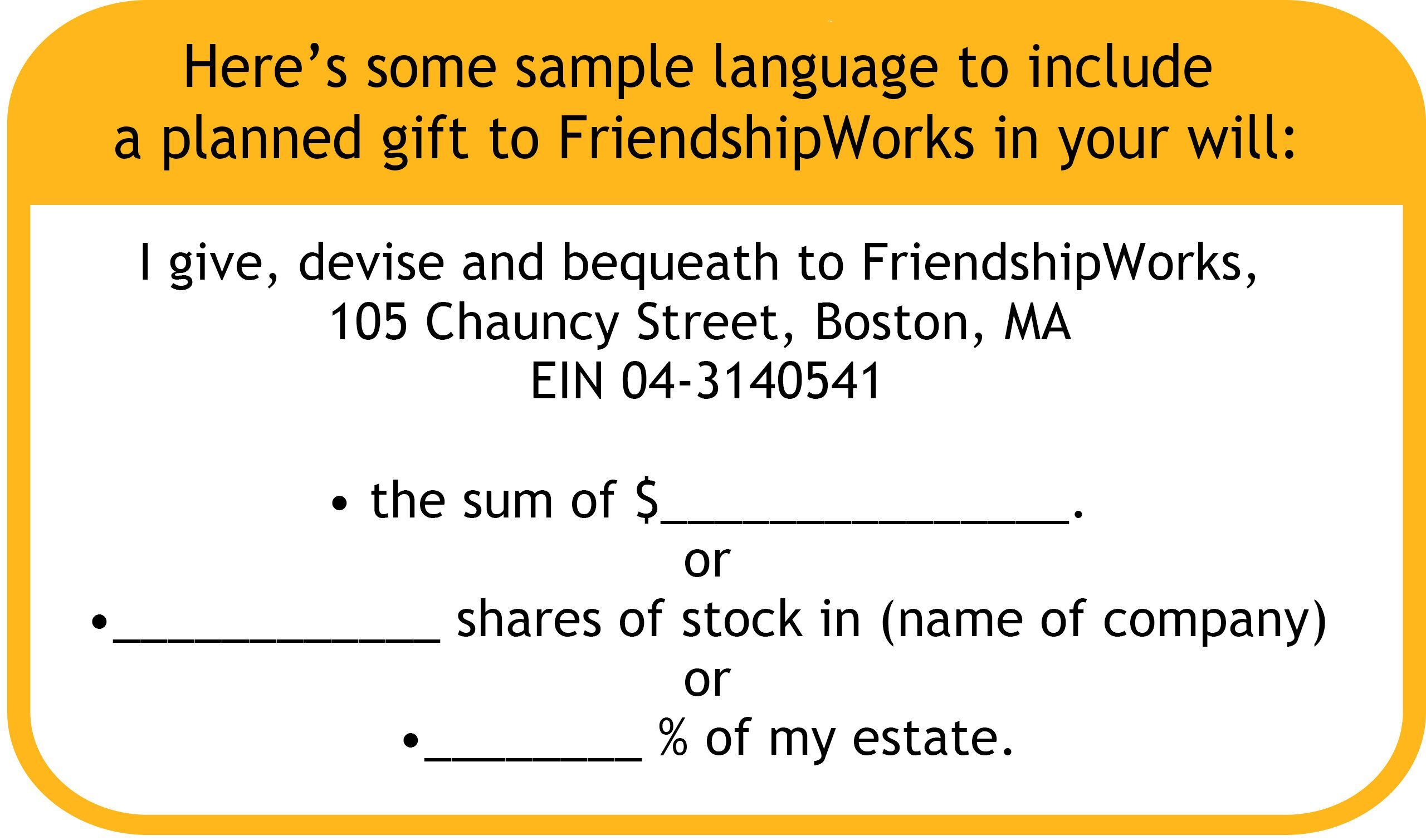

Some Legacy Society members, for example, have made provisions in their wills to “bequest” assets of cash, stock, Individual Retirement Accounts (IRAs), life insurance policies, and real estate. Sample wording to include FriendshipWorks in your will is provided below.

Examples of easy and tax-efficient planned gift options for you include:

Gifts by Will or Living Trust: Leave a bequest to FriendshipWorks of a set amount or as a percentage of your estate; you can also gift from the balance or residue of your estate or make a beneficiary designation of certain assets. Benefits of leaving a bequest include (1) leaving a lasting legacy to be remembered, (2) lessening the burden of taxes on your family, and (3) possibly receiving estate tax savings.

Gifts of Retirement Plans: Name FriendshipWorks as a beneficiary of your retirement plans; your retirement plan may be worth more when donated to FriendshipWorks than to your heirs.

IRA Distributions: If you or a family member are 70 ½ or older with an individual retirement account (IRA), you can make a tax-free gift to FriendshipWorks directly from your IRA, reducing your taxable income. This is called a qualified charitable distribution.

Gifts of Life Insurance: Name FriendshipWorks as a beneficiary of your life insurance policy; this is a wonderful way to make a special gift to FriendshipWorks without dipping into your capital assets.

Benefits of Becoming a Legacy Society Member

With any planned gift, you will automatically become a member of Legacy Society, and be honored, if you choose to be, in the following ways:

- Exclusive updates including Progress Reports, and invites to in-person gatherings and virtual Sharing Sessions with our Executive Director

- Invitation to our Annual Legacy Society Luncheon

- Tribute mention in FriendshipWorks’ annual Impact & Gratitude Report

- Name added to our Legacy Wall office plaque

- Recognition on our website

If you have already included FriendshipWorks in your estate plans, please let us know so we can thank you for your generosity and recognize you as a member of our Legacy Society.

Contact: Patricia Catalano, Director of Development & Communications

(617) 482-1510 X124 pcatalano@fw4elders.org

Note: The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor.